Author: Barbara Trummer

Urinary Tract Infection Myths

A urinary tract infection (UTI) is one of the most prevalent health problems that people face throughout their lives. Bacteria enter the ...May 31, 2023Read the instructions carefully on the kit to make the urine perfectly

Fake urine has been improvised for many years. The color is also made so that it looks exactly like human pee. Natural ...May 28, 2023Vaping on a Budget: Tips to Save Money

Vaping can be an enjoyable hobby and a great alternative to smoking, but it can also seem expensive at first glance. However, ...May 19, 2023Specific Testosterone Supplement Increasing Female Stamina

Naturally, testosterone levels fall as we become older. This is the right time for you to read the supplemental reviews and learn ...April 18, 2023Read honest reviews of the best keto diet pills and make a good decision to ...

Everyone with a desire to follow a healthy diet plan can focus on the most important things about a keto diet plan. ...February 1, 2023Brushing Your Teeth Before Going to Bed: How Important It Is in Ankeny?

If you are like many people, you occasionally forget to brush your teeth before going to bed at night. You may feel ...January 11, 2023Amazing Reasons Why You Should Get Dental Implants for Correcting Your Teeth Aesthetics

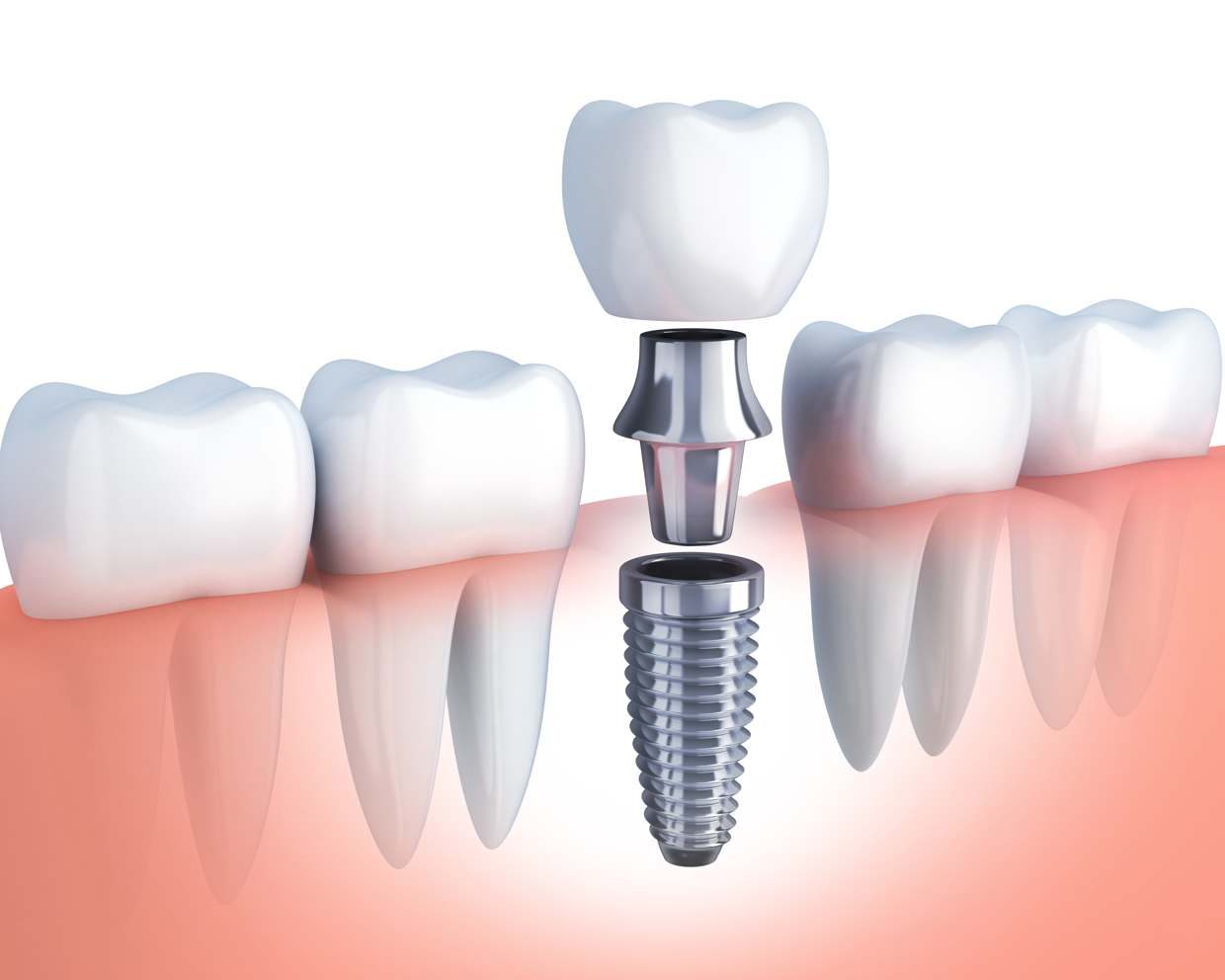

Dental implants are an effective way to replace lost teeth and enhance the overall appearance of teeth. If you are considering getting ...December 5, 2022How Long Can An Absence Seizure Last?

If you’re concerned about your child’s health, you’re probably wondering how long can an absence seizure last. Absence seizures cause a momentary ...July 22, 20226 Things To Consider When Choosing A Supplement

If a nutritional supplement found in shops like SNAC nutrition shop for example catches your eye, use common sense and follow your ...May 24, 2022Look for These Signs to Confirm That You May Also Need Rehab

It is challenging to be truthful and accept you have an issue relating to addictions. If you are experiencing bad consequences as a ...March 29, 2022

Categories

Latest Posts

-

Exploring the Benefits of the MedGuard Plan: Your Comprehensive Guide

February 27, 2026 -

What does a 200-hour yoga teacher training in thailand?

February 25, 2026 -

More Than a Cosmetic Choice

February 22, 2026 -

Choosing In Home Care in Brisbane and Queensland

February 18, 2026

© 2026 nutritionrealigned.com. Designed by nutritionrealigned.com.